For the next 90 seconds, please listen to Pam describe how to provide employees exactly the kind of fiduciary guidance they need in retirement transition:

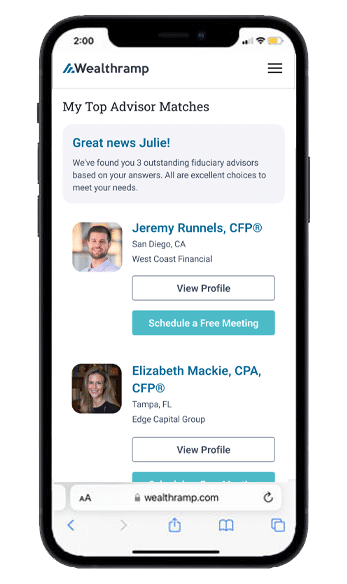

Trusted Fiduciary Advisors. Rigorously Vetted & Screened. No Brokerage Product Sales.

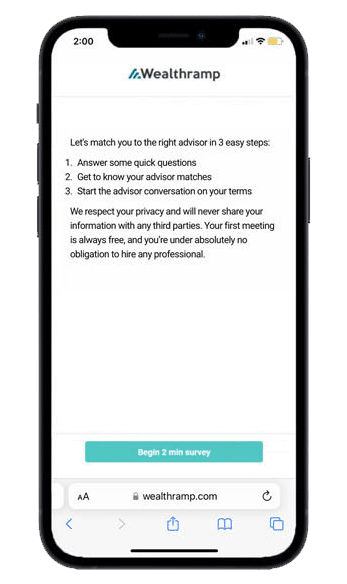

Help your employees access the trusted advice they need. Whether they’re just starting a savings plan, going through a life event or transition, or wondering if they’ll be prepared for retirement. There’s a financial advisor that can help navigate these situations, reduce financial stress and create the best outcomes.

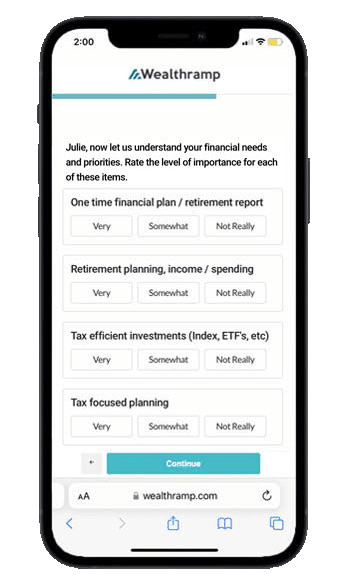

Fiduciary financial advisors can help with: